Publishings

Program Areas

-

Press Release

Federal Election Commission (FEC) Must Hold Hearings on Role of Digital Media in Political Campaigns

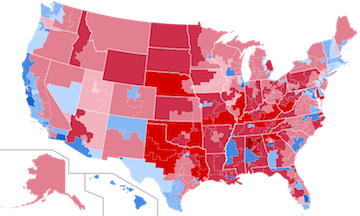

The Center for Digital Democracy calls on the Federal Election Commission (FEC) to hold hearings examining the role that the Internet and related digital data applications now play in federal political campaigns. The public needs a better understanding of how contemporary digital practices in the “Big Data” era affect our electoral system. CDD also urges the FEC to begin a rulemaking to revise its regulations concerning disclaimers so the public has appropriate access to information regarding the operations of online ads and related content. “The FEC must hold hearings to examine how, in this era of “Big Data” and personalized digital marketing, the unrestricted use of consumer information for political targeting may threaten our democratic process,” said Katharina Kopp, policy director of the Center for Digital Democracy. “Political campaigns now have access to an array of details on individuals that wasn’t previously available, including what they do online and offline. As we witnessed last year, this new capability can be used to engage in online suppression tactics to dissuade individuals and groups from voting. We urge the FEC to examine how digital data-driven campaigns may disenfranchise communities of color and economically at risk individuals." --- For more information, please see the attached media advisory and comment by the CDD. -

Political Microtargeting Threatens Privacy, Integrity of Voting Process

Big Data Election Marketing Practices Require Regulation, Safeguards

Haystaq DNA brings predictive analytics to election races up and down the ballot everywhere from presidential to city council elections. Haystaq provides support to political campaigns in need of using voter file data along with custom turnout scors, candidate support, issue scores and fundraising scores to reach voters most efficiently using a myriad of marketing tactics. --- --- For more information, visit http://bit.ly/2yrKQ0u (link is external) -

Learn about NCC Digital Media: the primary source for reaching consumers across all screens, helping brands target consumers across all screens. --- For more information, visit http://bit.ly/2gUeYq2 (link is external)

-

Time to Protect the Privacy of Voters in the Digital Age

Lack of US consumer data rules allows political groups to track & target you

Learn about CampaignGrid Direct, the most powerful online voter targeting with digital advertising for political professionals. For more information, visit https://campaigngriddirect.com/ (link is external) -

Google is a Publisher, as it Expands Video Content Services

Also bundles YouTube content and directly sells to advertisers

YouTube plans to produce a half-dozen original series that will be available for free on the world’s most popular video website, a big expansion of the Google (link is external)-owned company’s programming and efforts to attract advertisers. Comedian Kevin Hart, talk-show host Ellen DeGeneres and the comedy duo Rhett & Link are producing unscripted shows that will debut this year, YouTube will announce at an event for advertisers in New York Thursday. Alphabet Inc. (link is external)’s Google also will increase its spending on YouTube Red, a paid video and music streaming service launched in October 2015. The plans mark a shift for Google, which has typically treated its huge video library as a web free-for-all rather than a home for TV shows. But as more digital rivals venture into high-quality programming, YouTube is feeling pressure to respond, devoting resources to more costly projects and aiming for a wider audience. The company will fund more than 40 original shows and movies in the next year, spending hundreds of millions of dollars, according to a person familiar with the plans. YouTube is betting high-profile stars will attract more advertisers like Johnson & Johnson, which is sponsoring “Best.Cover.Ever,” a music competition from Ryan Seacrest that’s scheduled for later this year. “We’re working with YouTube stars and big celebrities that we know have global appeal, advertiser appeal and are largely established on the platform,” Susanne Daniels, YouTube’s head of original content, said in an interview. YouTube’s mission at the annual Newfront presentations in New York, where online companies are introducing their latest initiatives this week, is to convince marketers to shift more ad money to the web from TV. Original programming is front and center, with YouTube pitching premium shows that it says merit big commitments from sponsors. Those efforts got more complicated last month when advertisers discovered some of their spots appeared next to extremist videos (link is external). YouTube adopted new rules and said the scandal had minimal impact on sales. Still advertisers are wary of a site that relies on so many user videos, which makes it harder to ensure ads run alongside high-quality shows. “The two biggest players in the Newfronts are YouTube and Hulu, yet neither tells you exactly where your ad ran,” said Ben Winkler, chief investment officer of OMD USA, part of the Omnicom Group Inc. advertising company. “I expect YouTube will be the first to blink.” DeGeneres, who hosts one of the most popular talk shows on TV, will take viewers behind the scenes of her program. Hart, a popular comedian, will try a different trendy workout routine every week alongside celebrity guests in “Kevin Hart: What the Fit?” The show will debut on his Laugh Out Loud Network on YouTube. YouTube also will help Rhett & Link expand on their already popular “Good Mythical Morning” to create a series that feels every bit as grand as TV talk shows. While most recent episodes feature the two hosts at a desk, the revamped version, in its 11th season, will include more guests, challenges and correspondents. “We want to be seen as legit in ways by people who don’t see internet shows as legit,” said Rhett, whose real name is Rhett James McLaughlin. “But the way to do that is not to imitate late-night TV shows.” YouTube decided to fund ad-supported programs more than a year ago after executives saw a study on the growing number of TV shows being produced. Most of the new shows appear on premium services with no ads. That created an opening. --- Read more at https://bloom.bg/2y8Cdb2 (link is external) See Google program packaging for advertisers: https://www.thinkwithgoogle.com/products/google-preferred/ (link is external) -

Fox Links with Comcast for Targeting Individual Households via Set-top boxes & Streaming

ISPs, Programmers, Digital Platforms, Advertisers web of connected relationships require antitrust and consumer protection scrutiny.

Fox Network Groups has begun selling advertising in the video-on-demand content from its channels that is addressable on an individual household basis through Comcast Cable set-top boxes and streaming via Hulu. TV networks are looking for ways to create innovations in advertising that can increase its value in an increasingly digital age. Fox has already been selling precision audience targeted ads on its linear network with its AIM solution. It is also a partner in Open AP, which is attempting to standardize selling ads based on specific audience targets rather than the traditional broad age and sex base demographic groups. Comcast Cable has done addressable ad campaigns using dynamic ad insertion technology with its corporate sibling NBCUniversal. Working with Fox is part of a trial program to see how the distributor can work with programmers on addressable advertising. A source indicated that Comcast is conducting addressable trials with another, unnamed, network group. Both Fox and Comcast use Freewheel, a division of Comcast, to handle ad insertions. Fox’s addressable effort is unique because in addition to working with Comcast’s subscribers, it can also offer viewers streaming on-demand programming from Fox Networks including Fox Broadcasting, FX, National Geographic and Fox Sports via Hulu. Noah Levine, senior VP, advertising data & technology solution at Fox Network Group says that between Comcast and Hulu Fox and its advertising clients more than 10 million households on an addressable basis. Levine was expected to announce Fox’s new addressable advertising effort at the B&C/Multichannel News Next TV Summit in New York Wednesday (Oct. 18), part of NYC Television Week. “Our strategy is to continue selling to linear buyer through Fox AIM linear,” Levine said. “Now we can also work with the addressable buyers to pursue the addressable opportunity.” Fox is looking to add cross-platform precision audience targeting. “Our goal is to be able to provide audience targeting across our very wide portfolio of content regardless of the distribution modality,” Levine said. --- Read more at http://bit.ly/2ivJvyx (link is external) -

Google Brings Big Data Personalized Ad Targeting to TV

Smarter TV Ad Breaks Automatically Optimize Your Ad Break to the Revenue-Maximizing Combination of Ads, Personalized and Relevant for Each Viewer

Google's DoubleClick team October 2017 Opt-Ed piece: I believe that the future of TV is one that’s smarter — that brings together the TV content you love with the seamless experience of digital — on every screen or surface. Building towards that future, at our Partner Leadership Summit in Chicago early this month, we announced several new products and features to DoubleClick for Publishers, made for our TV. Video ad experiences get smarter, live and on-demand, with Dynamic Ad Insertion Over the years, we’ve rebuilt our video platform from the ground up — we knew that TV was a very different experience from the web and we knew that broadcasters had different challenges, infrastructure, distribution partners and content from web publishers. With TV coming to digital, we put our stake in the future of building for a better user experience — one that was connected, always on, and on-demand. Powering dynamic ad insertion has become a leading benefit of our platform. Over the last couple of years, we’ve successfully powered dynamic ad insertion for live streaming and on-demand content for many of the largest news, sports events and episodic premiers. In fact, over the past two years alone we’ve seen a 4X increase in ad impressions delivered via our Dynamic Ad Insertion product by TV partners like CBSi, AMC, Bloomberg, TF1 (link is external) and many more. Smarter TV ad breaks optimize revenue within each pod, programmatically We’re also bringing new updates to a key feature of our platform — smarter TV ad breaks. With this update, ad slots no longer need to be sold as fixed lengths in the break. Smarter TV ad breaks automatically optimize your ad break to the revenue-maximizing combination of ads, personalized and relevant for each viewer. For example, a ninety second ad break can now be filled by two 15-second and two 30-second ads or one 15-second, one 60-second and two 6-second bumper (link is external) ads depending on what will bring you the most revenue. Importantly, we’re able to do this across your programmatic or reservation deals, while respecting your business rules, such as competitive exclusions and frequency capping within the break or stream. Content gets smarter with TV Content Explorer To effectively monetize TV content, you need a platform that can better understand the content you’re monetizing, the audiences engaging with it and serve the right ad in just the right moment no matter where users are consuming it. That’s why we’re launching TV Content Explorer in DoubleClick for Publishers, available in beta by the end of 2017. Leveraging Google’s machine learning expertise and smart heuristics, TV Content Explorer creates and automatically organizes an intuitive catalog of your shows and clips. We analyze millions of signals from video content feeds, automatically applying classifiers and making recommendations for how content should be organized across dimensions like show, genre, trending, dayparts, etc. With this inventory catalog, you’ll get a clearer view of the opportunities and packages available to sell. But that’s not all. To ensure that you aren’t leaving any revenue on the table, the Explorer will also proactively surface deeper insights into audiences and monetization opportunities via insight cards (link is external). We’re just scratching the surface of what’s possible with this feature and are excited to bring even more innovation to this Explorer in the future. --- For the full article, please visit http://bit.ly/2zvJUEk (link is external) -

Google Continues Big Data-Driven Tracking and Analyzing of Individuals for Cross-Device Targeting

Presented by the Google Agency blog "Introducing Ads Data Hub: Next generation insights and reporting"

Mobile has fundamentally changed how we live our lives. With our devices never more than an arm’s length away, people can find, watch or buy anything at anytime. That’s why earlier this year we shared (link is external) that we’re developing a new, cloud-based measurement solution for YouTube, designed for a mobile world. Today, we’re announcing the beta for this solution, Ads Data Hub, to help advertisers get more detailed insights from their campaigns across screens while also protecting user privacy. We are also announcing that Ads Data Hub is a solution not just for YouTube, but a tool that offers access to more data and helps unlock actionable insights across Google ad platforms, including the Google Display Network and DoubleClick. And with Ads Data Hub now in beta, we’re expanding who can use it. Built on infrastructure from Google Cloud, including BigQuery (link is external), Ads Data Hub gives advertisers or their preferred measurement partners access to detailed, impression-level data about their media campaigns across devices in a secure, privacy-safe environment. Data from other sources, such as a CRM system or marketing database, can be incorporated as well. With this full view, advertisers or their partners can analyze the data and draw out insights specific to their business. For example, if an e-commerce retailer wants to understand what the path to conversion looks like, they can bring additional online data about their customers into BigQuery, and Ads Data Hub will enable them to combine that data with their ads data so they can see what a typical journey is from first encountering a user until conversion. Consistent with our commitment to privacy (link is external), no user-level data can be removed from the secure Cloud environment. Impression-level data is only accessible for the purposes of analysis and generating insights. In the future, advertisers will be able to act on the insights they get from Ads Data Hub and buy media with greater precision. As an early alpha partner, Omnicom Media Group helped to define the solution and has seen significant value from both the amount of data available through Ads Data Hub and the broad set of analyses and custom queries that are possible. --- For the full blog post, visit http://bit.ly/2yBWYv1 (link is external) -

Digital Data Targeting of Political Ads Require 21st Century Voting Safeguards, inc. for Privacy

Here’s what Verizon does:

'One by AOL: Politics', a full-scale programmatic solution that inspires voters at the "right time", in the "right context" in an increasingly video and mobile-led world. Use of this platform allows political brands to create, execute and optimize on digital buys to reach voters. --- For more information, visit https://www.onebyaol.com/politics (link is external) -

Google + Ad Industry Study Shows Influencers on YouTube Sell Snacks, Toys, Alcohol

Illustrates Need for 21st Consumer Safeguards for Unfair/Deceptive Marketing

Sanjay Nazerali, Chief Strategist of Carat, a global media market leader in digital media, writes about how YouTube influencers are rewriting the marketing rulebook. Working in strategy at one of the world’s largest media agencies, I’ve witnessed countless pitches about influencer marketing and the growing power of creators. With engaged audiences in the millions and passionate fans hungry for content, YouTube creators are already an established channel for brands looking to run ads. In fact, Carat’s latest analysis suggests online video investment (including YouTube) can be increased by 3X compared to planned level. But increasingly, these influencers are also becoming attractive partners for deeper collaborations. Clients are initially enthusiastic, assuming this is the digital age’s answer to celebrity marketing and endorsement. Then the thorny business questions arise, such as: So what’s it actually doing for my brand? Do I do an endorsement or product placement—or what? Isn’t it just for millennials, beauty brands, and makeup tutorials? These have always been tough questions to answer. Even though almost everyone has been jumping on the influencer bandwagon, few understand what “influence” really is or how it works. Until now. Celebrity marketing and influencer marketing offer fundamentally different benefits for brands. Together with YouTube and Nielsen, my team analyzed the results of hundreds of brand and creator videos in the U.S. and the U.K to understand the impact of influencers for brands. It’s a critical first step in establishing a business-led rulebook for this new world—and it’s already changing how I approach my own plans. 1. Influencers are not the same as celebrities Influencers, however vast their reach, are absolutely not “today’s celebrities,” and celebrity marketing and influencer marketing offer fundamentally different benefits for brands. For instance, we found that celebrities are more effective at driving recall than creators (84% versus 73%). Given that a celebrity’s job is to be famous and memorable, that makes sense. Where YouTube creators really start to gain the upper hand is in deeper brand involvement. Brand familiarity is a good example. If we want to get an audience to really understand us, our work, our values, or our products, then collaborations with YouTube creators are 4X more effective at driving lift in brand familiarity than those with celebrities. When it comes to purchase intent, it’s an even match: our research found that influencers were just as likely as celebrities to drive buying decisions. Influencer marketing appears to play a fundamentally more pragmatic role. Why? My hunch is that it’s because fans feel very connected to the YouTubers they love. The best creators have formed authentic bonds with their fans, which means fans trust what they have to say, and turn to them for brand and product recommendations. 2. It’s not just a ‘beauty’ thing Beauty brands were one of the first to team up with influencers, and creators have established a huge presence among the YouTube beauty community. About 86% of the top 200 beauty videos on YouTube were made by creators rather than professionals or brands. But what’s interesting about our findings is just how far influencers stretch beyond the beauty category. We tested nine additional categories, including auto, alcohol, snacks, and toys. Across all nine categories, working with influencers leads to lifts in brand metrics, from familiarity to affinity to recommendation. In some categories, such as snacks and alcohol, they can have even more impact, driving significantly higher than average purchase intent. So the idea that influencer marketing is purely for young people who are looking at fashion and beauty brands simply isn’t true. 3. The ‘how’ matters as much as the ‘who’ Celebrity marketing has historically focused on endorsement, sponsorship, and product placement. Influencer marketing has developed far more options, and it’s important to understand which of these work best—and for which marketing goals. Deep thematic integrations with creators stand out as driving the highest results for brands. These are more involved integrations where the influencer plays a role in creating a piece of content – such as a demo – with the brand. It’s far deeper than product placement and it works more effectively. While there were many consistencies across categories, we also saw some nuances, which are important for clients to understand. We found that simpler brand integrations, like a product endorsement or just featuring a creator in an ad, also showed positive results for brand affinity in all categories tested. Of course, deep collaborations can be more than some brands are ready for. For some objectives and categories, simply running their own ads on YouTube creator content will still be the easiest and most effective way to tap into the power of these influencers. 4. Don’t lose sight of why people love YouTubers We often assume that the right influencer is either an aspirational version of our target audience or that they’re just like celebrities. Neither of these assumptions is correct, and it’s perhaps here that celebrity and influencer marketing differ the most. Whereas celebrities need to be trendy and stylish, consumers expect creators to be friendly, funny, and, yes, sometimes irreverent. Irreverence is interesting, because it drives credibility. Irreverence strongly suggests independence, and it’s this that builds trust. It can also be incredibly valuable for brands. If a creator usually ridicules things they don’t like, you can be sure that when they praise something, they mean it. Humour is also interesting, because it reflects a sense of community. YouTube helps forge a special relationship between followers and influencers, one that reflects a sense of co-ownership. This familiarity creates a degree of intimacy that makes the use of humour seem much more natural than it would do with celebrities. This is probably also why we see celebrities, such as Dwayne Johnson, increase their influencer scores when they get really active on YouTube. Prioritization and strength of attributes by gen X and gen Y associated with celebrities are different to creators. --- For the full article, visit http://bit.ly/2z6MHng (link is external) Is it Hype? Or is it Real? Decoding the Influence of YouTube Influencers Read more at http://newyork.advertisingweek.com/CALENDAR/-google-seminar-2017-09-26-1... (link is external) -

Leading radio streaming service Pandora partners with Oracle Data Cloud (link is external) on two important measurement initiatives: a custom offline sales meta-test of consumer packaged goods (CPG) campaigns and automotive Buy Through Rate (BTR) measurement. Connecting online ad exposure to offline sales requires billions of data points. Massive scale is crucial. With more than 76 million logged-in listeners per month, 1 billion data signals every day, and cross-platform reach, Pandora is uniquely positioned to provide our advertisers with the crucial data they need. In both the CPG and Auto studies, Pandora‘s listener data was matched anonymously, one-to-one with Oracle Data Cloud user-level data set. Pandora’s cross-platform media was then connected with offline transactional consumer data from the Oracle Data Cloud. For marketers, being able to accurately measure a campaign’s impact on in-store sales truly is the holy grail. With 67% of the buyer’s journey (link is external) happening online, digital marketing has never been more directly connected to offline sales. It’s also the thing that keeps marketers awake at night and a challenge that here at Pandora, we’ve taken to heart. Campaign-level sales insights are equally important for automotive marketers as their CPG counterparts. Yet, auto purchase cycles are even longer and more complex, making sales attribution a struggle. Pandora is proud to lead the charge in this space and is the first non-endemic publisher to leverage Oracle Data Cloud Buy Through Rate at a raw impression/user level, exposing detailed and granular campaign-level insights. --- For more information, visit http://bit.ly/2g3Ic5u (link is external)

-

Learn more about Krux’s data management platform solution ‘marrying human insight and machine learning’. People are unique, from their different characteristics to preferences to behaviors. People engage with brands in infinitely different ways, and they certainly don't fit neatly into standard audience personas. More granular and dynamic audience segments can be discovered and defined through Salesforce DMP machine learning capabilities powered by Einstein. Salesforce DMP Machine-Discovered Segments deliver: Machine-learning algorithms that detect similarity and correlation between users to find hidden patterns and behaviors Prescriptive audience recommendations based on all data sources Unique audience personas that differentiate and augment the value of your first-party data Intelligently targeted and personalized engagement Complete analysis and actionable data to discover, activate, and measure Key Features include: Programmatic Attribution Modeling: Smart insights for smart ad buys and activation across all screens, channels and systems. Turnkey Lookalike Modeling: Audience expansion in which you control the tradeoff between reach and similarity, without reliance on external black box providers. Restricted Data Leasing: Safe, supervised data flow to authorized partners according to times, terms and conditions of your choosing with automated tools for auditing and verification. --- For more information, visit http://bit.ly/2xghY5Y (link is external)

-

Learn more the Audience Center 360, a Google analytic solutions data management platform that helps brands make strong decisions based on a complete understanding of their audience insights, and create relevant and engaging experiences across the entire customer journey. --- For more information visit, http://bit.ly/2xSzX6a (link is external)

-

Blog

Big Data Turns Your TV into Powerful Digital Spy

Simulmedia, Oracle Data Cloud Partnership Aims to Bring Data-Driven Ad Targeting to Linear TV Networks

Targeted TV ad company Simulmedia is partnering with Oracle Data Cloud, a data service company, to target advertisements to consumers based on their in-store purchases. Data-driven advertising is picking up in the linear TV world as cable companies look to cash in on the big data trends that digital platforms base their decisions on already. The data that Oracle Data Cloud is providing via Simulmedia is worth more than $3 trillion in household-level purchase data, according to the announcement (link is external). Simulmedia’s “VAMOS” platform creates data-driven audiences, predicts viewership of the audiences, builds optimized performance-based media plans and reports on media delivery and outcomes. “Bringing Oracle Data Cloud’s purchase-based audiences to national television is a defining moment in the transformation of TV to a data-driven, audience targeted business,” said Dave Morgan, founder and CEO of Simulmedia, in a statement. “By using Simulmedia’s VAMOS platform to precision target Oracle audiences on national TV, brands can align their audience strategies across TV and digital and improve the overall ROI of their advertising spend.” Joe Kyriakoza, vice president-general manager for automotive and TV for Oracle Data Cloud, told MediaPost (link is external)Thursday that this is the first announced partnership in the TV space—though for years the company has already been targeting ads this way in digital. Simulmedia claimed that advertisers will receive an average of between 30% and 100% higher ROI for every campaign. Oracle Data Cloud’s audience numbers quantifying offline transactions are aggregated through data from Oracle’s relationship with Visa Advertising Solutions and DLX Auto audiences, powered by Polk from IHS Markit. Marketers will also be able to deliver ad campaigns to syndicated and custom audience segments from Oracle’s BlueKai Marketplace, as well as onboard their custom CRM and other first-party data. --- For the full article, visit http://bit.ly/2xCxIlD (link is external) -

Blog

Consorting With the Frenemy: Ad Tech Players Partner For Shared Identity Matching

AdWeek article written by James Hercher

Seven independent ad tech companies debuted a programmatic consortium on Thursday that pools their supply- and demand-side cookie IDs into one shared identity asset. The consortium is helmed by AppNexus, MediaMath and LiveRamp, which provides the data matching. Other launch partners include Index Exchange, Rocket Fuel, LiveIntent and OpenX. And it’s a shot across the bow of Facebook and Google, which suck in a majority of digital ad dollars. “The big giants have had an advantage over the open internet in that they have their own deterministic identities for users that allows more precise targeting and cross-device matching,” said AppNexus product VP Patrick McCarthy. Ad tech platforms like AppNexus, Index Exchange and OpenX have the combined online reach marketers want, McCarthy said, but an advertiser must match its data against each platform independently and use LiveRamp to create one-to-one matches. “A universal cookie ID eliminates all the user syncing that goes on between platforms and the lower match rate that necessarily goes with it,” he said. While Google and Facebook have users who contribute deterministic data, the newly formed ad tech consortium can apply first-party data from advertisers and logged-in data from publishers. Marketers and supply sources who are a part of the consortium will access for free the shared cookie pool. LiveRamp’s cross-device graph IdentityLink can be extended to the campaigns, but LiveRamp is still considering commercial terms for ad buyers who want to add a cross-device matching component, company CMO Jeff Smith told AdExchanger. The lack of a unique identifier to date has been one of the biggest factors in fueling concerns around transparency, fairness and control in the digital advertising ecosystem For now, though, any marketer who wants to take advantage of the consortium’s cross-device offering must be a LiveRamp IdentityLink customer. Smith is acutely aware that LiveRamp gains a new business funnel, noting that onboarding potential consortium partners is “definitely is a benefit for us.” “And hopefully the broader benefit is if everyone standardizes around a common identity, the value and efficiency of their marketing will go up,” he added. While the DSPs and SSPs in the consortium may not view it as a new business play, “there certainly will be benefits” that could lead to budget and supply-source consolidation, said MediaMath product VP Philipp Tsipman. For instance, a European video supplier working with MediaMath on a campaign could match its viewers one-to-one with MediaMath’s cookie pool. If that relationship were to occur through the consortium, the match rates would be higher and the profiles would be more robust, since suppliers across the web are contributing data as well. AppNexus’s McCarthy said the system doesn’t cut off buyers from suppliers that don’t use the consortium, but “they will get better matching and better results, so it could naturally funnel more budgets to suppliers that participate.” The market needs “a unique identifier that is neutral,” said OpenX CEO Tim Cadogan in a statement about joining the consortium. “The lack of a unique identifier to date has been one of the biggest factors in fueling concerns around transparency, fairness and control in the digital advertising ecosystem.” --- For the full article, please visit http://bit.ly/2fLZtAB (link is external) -

Blog

Political Scholars, NGOs Call on Facebook, Digital Industry to Support Rules for Political Campaigns

Released on September 22, 2017 at a political microtargeting conference held in Amsterdam, in response to the recent announcement by Facebook and Mark Zuckerberg on changes to how they conduct political ad campaigns. Dear Mark, Your statements on Facebook’s new policies for political advertising were issued as we started a global symposium on micro-targeting in Amsterdam (https://www.ivir.nl/amsterdam-symposium-on-political-micro-targeting/ (link is external)). We are a group of leading international academic experts and civil society representatives from the fields of law, communication, political science and economics who are conducting research on political targeting. Fairness, equality and democratic oversight are key in democratic societies. We appreciate the initiative you have taken and strongly encourage further dialogue and action. Moving this forward we strongly believe that the principles of transparency and disclosure are essential. Facebook should share publicly the full range of paid political contents, disclose the sponsoring actors, and identify the categories of target audiences. This should be done globally as this is an issue that affects elections worldwide. We encourage you and other platforms and actors to join this dialogue to contribute principles for transparency and disclosure. Transparency is a first step in the right direction. Digital political advertising operates in a dynamic tension between data and humans, commerce and politics, power and participation. Some of these tensions can be resolved by transparency, others not. The way forward is to engage with governments, regulators, election monitoring bodies, civil society and academics to develop public policies and guidelines for ensuring fairness, equality, and democratic oversight in digital political campaigns. Can we count on you? Natali Helberger Institute for Information Law (IViR), University of Amsterdam Claes de Vreese Amsterdam School of Communication Research (ASCoR), University of Amsterdam Balazs Bodo Institute for Information Law (IViR), University of Amsterdam Mauricio Moura George Washington University Max von Grafenstein Alexander von Humboldt Institute for Internet and Society, Berlin Jessica Schmeiss Alexander von Humboldt Institute for Internet and Society Sabrina Sassi Universite Laval Tom Dobber Amsterdam School of Communication Research (ASCoR), University of Amsterdam Jeff Chester Center for Digital Democracy, Washington, DC Kathryn Montgomery American University, Washington, DC André Haller Institut für Kommmunikationswissenschaft, Universität Bamberg Damian Tambini Department of Media and Communications, London School of Economics and Political Science Simon Krischinski Johannes Gutenberg Universität Mains Daniel Kreiss School of Media and Journalism, University of North Carolina at Chapel Hill -

Digital marketing companies, especially Facebook (link is external) and Google, allied with super-size broadband ISPs (AT&T, Comcast, etc.), defeated (link is external) a bill that would have given Californians the right to have a say in how their digital information can be used. The bill primarily required (link is external) opt-in consent (an informed, informative okay) before our data could be used to help advertisers target us via a home or mobile Internet connection. Google, Facebook, AT&T, Comcast and their partners don’t want individuals to be able to decide for themselves whether they want to be part of these companies’ commercial surveillance system. Working both independently and collectively, the digital marketing businesses can now seamlessly (link is external) gather, analyze and use all our information—whether we are on a mobile device a PC or even watching TV. Our mobile phones and apps send them details of where we go and what we do. All of our “profile” information is collected into a single record, which often contains an ever-growing (link is external) array of other data—about our finances, health, what our kids do, what we view online, where we shop and for what, our race, ethnicity, sexual orientation and more. Google and Facebook use this data to generate massive revenues from advertisers, marketers and political campaigns. AT&T, Comcast, and Verizon have long had “Google envy,” believing that their monopolistic control over the broadband connections most Americans rely on should also shower them with even more financial rewards. That’s why phone and cable companies have scooped (link is external) up digital ad companies, such as Yahoo and AOL. Their vision for the future is to profit significantly by selling us to advertisers when we use our digital devices to stream video, listen to music, play games, etc. The California bill was based on the safeguards that had been enacted by the FCC at the end of the Obama administration, but that President Trump eliminated (link is external) earlier this year and. Google, Facebook and the others knew that if California enacted such consumer safeguards, it would set a powerful precedent. That’s why they engaged in a deceptive (link is external) ad campaign, used their political donations (link is external) for clout with lawmakers, and sent lobbyists to the state to tell tall tales of how Americans have their privacy protected by the FTC. A terrific coalition (link is external) of privacy, consumer, education, children’s advocacy, civil rights and civil liberties group fought for the California bill. We are proud that CDD played a modest role. We will all be back, stronger than ever, when the California state legislature reconvenes next year. But the lesson here is a valuable one and joins the now-almost-daily examples where Google (link is external), Facebook (link is external) and the others misuse their power. The forces of advertising and marketing, now fueled with the ever-growing capabilities of digital applications, undermine the ability of America’s communication and information gatekeepers to effectively serve the public interest. It’s a story that has been repeated throughout the 20th century with the mediums of radio, broadcast television and cable. It’s also always been true of the Internet companies. Protecting our privacy, by stopping these companies from so easily grabbing and monetizing our data, is one way we need to address the problem. The Europeans are about to do precisely (link is external) that—and the U.S. needs to do the same. That’s a very important beginning for what must be a new national agenda protecting the digital rights of all Americans.

-

Integrated into their end-to-end platform (link is external), Smartplay provides a real-time, one-to-one connection (link is external) to viewer’s device, enabling them to optimize monetization opportunities. Smartplay’s server-side ad insertion technology (link is external) and industry-standard ad-decisioning system are used to deliver personalized ad experiences across live, linear and on-demand programming. By enforcing advertising business rules according to their monetization strategy, Smartplay enables smarter advertising to help customers get the most value out of their online content. --- For more information, please view the attached PDF and visit http://bit.ly/2w385c7 (link is external).

-

“Marketers. Ready, aim, engage! It is easier than ever to hit the right marketing targets,” explains Equifax (link is external) about its far-reaching data capabilities that capture, analyze, and sell our information. Equifax’s admission last week about its loss of personal information on 143 million Americans—including Social Security and drivers license numbers—is also a wake-up call about the dramatic loss of our privacy in the digital era. Most people think of Equifax as one of the “Big 3” credit-reporting agencies that provide information on our credit worthiness. But Equifax also profits from compiling and selling our data profile to financial services, retail, auto, telecommunications, and other industries for online targeting. As the company itself explains, “Equifax has grown from a consumer credit company into a leading global provider of insights.” It has built a major business offering (link is external) “audience profiling, targeting and measurement tools” that reflect data practices that undermine our privacy and can threaten the interests of consumers. As it explains (link is external) in its “Equifax for Marketing? Absolutely” document, “the advent of Big Data presents nearly limitless potential to help identify the most profitable customers and prospects…. Our data-driven marketing solutions help you synthesize consumer data for a holistic, 360-degree customer view.” Equifax pulls together and “enriches data from disparate sources” so others can have an “enhanced view” of who we are and what we do. Unfortunately, that “enhanced view” means trampling on what should be our right to control who has access and can use our information. We shouldn’t be focused only on the loss of our information from a data breach—but also on how we can better address this issue at its core—by stopping the massive and stealth ways our data are being gathered and used in the first place. Just last month (link is external), Equifax further consolidated (link is external) its “data assets” to create what it calls its “Data-Driven Marketing” suite (DDM). It now provides “a single point of access to all of its data” in order to make using it more convenient for marketers. Equifax’s current business practices reflect how our personal data is traded, shared, and sold today. An array of partners (link is external) collaborate to share information on an individual or a group to be targeted. Data from different sources are gathered, analyzed to identify patterns and opportunities; we are segmented and scored, given an invisible label that describes our financial status and behavior, and that information is then fed into superfast computers that deliver pitches and offers to us via mobile phones, PCs, and connected TVs. In its “Data-driven Marketing Solutions” paper (link is external) on financial services, Equifax touts its ability to directly measure “over $15 trillion of U.S. consumer investable assets…and credit data for over 220 million consumers in the U.S.” Equifax says that it can take that data to help clients target individuals “across channels: email, display, mobile, addressable TV, social, direct mail, point-of-sale, [and] call center.” This is what’s known as “omnichannel” marketing, and involves following us wherever we go online, and, via our mobile phone and apps, into stores and other physical locations as well. For example, Equifax’s IXI (link is external) Services division enables marketers to “differentiate consumer households and neighborhoods, based on wealth, income, spending capacity, share-of-wallet and share of market.” One of its products—AudienceIntel (link is external)—“helps you understand the financial profile of your site visitors…[using] intuitive targeting segments based on our proprietary measures of households’ financial capacity, propensities, preferences, and behavior.” Among IXI’s “digital targeting segments (link is external)” are those who may need a “sub-prime credit card,” a “revolver” (someone with a high balance and will have to accrue interest charges), a “likely student loan target,” and “active debit card users.” Equifax’s IXI promises that it can help guarantee that its clients’ ads have been viewed by their “desired target audience” and whether a sale or some other response was completed—“online or offline.” Unlike Experian and Acxiom, Equifax’s IXI “receives data directly from financial institutions,” which it can segment in a more granular way, according (link is external) to trade reports. Equifax’s “TokenIntel (link is external)” provides retailers with additional insights into our lives by linking point-of-sale and online transaction data with our use of credit cards. This includes geo-location information as well. Although Equifax claims its processes are privacy friendly, the technology it uses enables it to know each consumer and “household, allowing for a clearer picture of a household’s likely value to your brand.” “Communicate with shoppers like you know them…Because You Do!” Equifax explains, urging potential clients to work with it so that “your millions of transaction data points become the foundation” of more profiling and targeting of individuals. Equifax has allied itself with other leading digital data companies that use cutting-edge ad technologies that help target us in milliseconds. They are now working (link is external) with Adobe, Lotame, Salesforce’s Krux, Neustar, MediaMath, and Acxiom’s LiveRamp (link is external), for example (as well as working with music site Pandora (link is external)). In other words, Equifax is helping other data targeting companies gain access to our information—an example of the out-of-control data system unleashed today. Because the U.S. doesn’t have any federal consumer privacy law—rules that the digital data and ad industries are violently opposed to—there’s nothing stopping them from collecting and using even more of our information. The breaches that are occurring begin the very first time a company takes our data, without any legal limits on what that company can do with such information. ---